When Shareholder Primacy Meets a Burning World

By Paulo Santos

There is a particular kind of collective amnesia that settles over a society when the consequences of its foundational choices become unbearable. We call disasters “unfortunate,” outcomes “unexpected,” and systemic cruelty “market failure.” Anything, really, except admitting that what we are witnessing is not malfunction but obedience.

The recent spectacle of insurers abandoning homeowners in wildfire‑prone regions—leaving entire communities uninsured just before catastrophe strikes—is not a moral aberration. It is the end stage of a legal doctrine that was deliberately constructed, judicially enforced, and culturally normalized over the last century.

This story does not begin with climate change. It begins in a courtroom.

Help fuel the work. Independent analysis doesn’t fund itself:

☕ Buy us a coffee

The Case That Rewrote Corporate Purpose

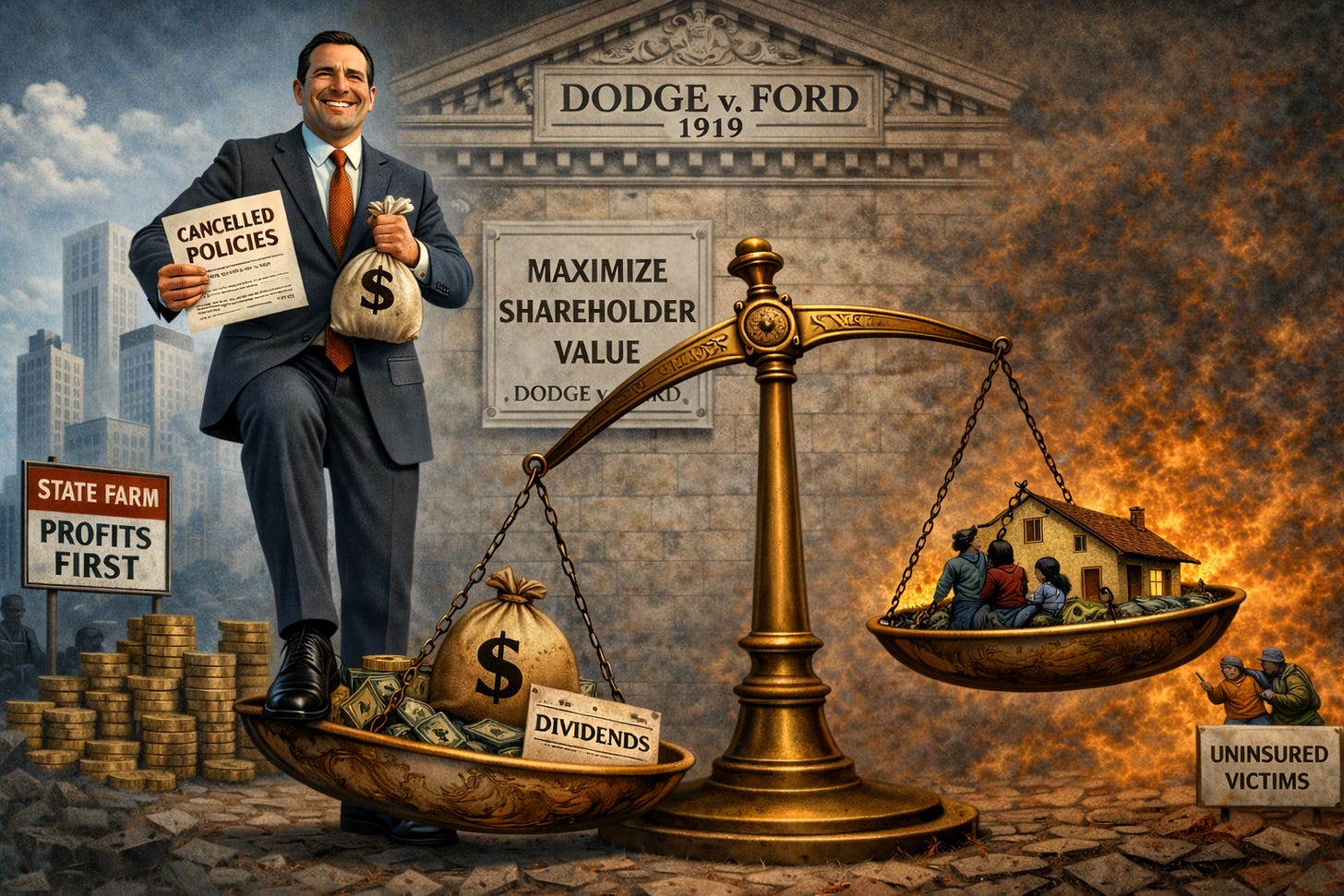

In 1919, the Michigan Supreme Court decided Dodge v. Ford Motor Co. The facts are straightforward and, in retrospect, damning.

Henry Ford wanted to reinvest company profits into expanding production, lowering car prices, and raising worker wages. He believed—radically, by today’s standards—that a corporation could exist to serve broader social ends alongside profitability.

The Dodge brothers, minority shareholders, sued. Their argument was not that Ford was mismanaging the company, but that he was insufficiently prioritizing shareholder dividends.

The court sided with the shareholders.

The ruling established a principle that would metastasize across American corporate law: a corporation exists primarily to generate profits for its shareholders. Any deviation—any attempt to subordinate profit to social good—was permissible only if it did not interfere with that obligation.

This was not a narrow decision. It was a normative one. The judiciary took a side in a philosophical debate and encoded that side into enforceable law.

Corporate leaders were noalized accordingly. Profit maximization was no longer just a strategy; it was a duty.

Fiduciary Duty as a Weapon

Once shareholder primacy becomes the governing rule, everything else follows.

Executives who choose restraint over returns expose themselves to lawsuits. Boards that weigh human costs over quarterly earnings risk removal. Institutional investors punish deviation ruthlessly. The system selects for those willing to externalize harm.

This is why contemporary defenses of corporate cruelty so often sound procedural rather than ideological. Executives insist they “had no choice.” And within the legal framework we have built, they are often telling the truth.

Fiduciary duty has become a moral shield—one that allows actors to disclaim responsibility for outcomes they actively engineer.

Insurance in the Age of Climate Collapse

Insurance is often mischaracterized as a social good. In reality, under shareholder primacy, it cannot function as one.

An insurance company does not exist to provide stability or security. It exists to collect premiums and minimize payouts. Risk is not something to be shared; it is something to be priced, segmented, and discarded.

When climate models indicate that certain regions are likely to burn, flood, or collapse, the “rational” response under this doctrine is not mitigation or adaptation. It is withdrawal.

Drop the policyholders. Avoid the payouts. Preserve the balance sheet.

What happens to the people left behind—families who lose homes, savings, and any chance of recovery—is not the insurer’s problem. It is someone else’s externality.

This is why entire communities can be rendered uninsurable overnight without violating any fundamental principle of the system. The cruelty is not accidental. It is compliant.

The Myth of Market Failure

Mainstream commentary often frames these outcomes as failures of regulation or temporary distortions in otherwise functional markets. This framing is deeply misleading.

Markets did not fail here. They executed their mandate.

The system did exactly what it was instructed to do: optimize for shareholder returns under conditions of rising risk. That the result is mass displacement and financial ruin is not evidence of breakdown. It is evidence of alignment.

Calling this a “failure” allows us to preserve faith in the underlying structure while condemning individual outcomes. It is a comforting lie.

Why Reform Narratives Fall Short

Proposals to tweak insurance regulations or offer limited backstops miss the larger point. As long as shareholder primacy remains the organizing principle of corporate governance, these measures can only mitigate symptoms, not causes.

A corporation legally barred from prioritizing human welfare will always find ways to evade responsibility when doing so is profitable. No amount of moral exhortation can overcome a system that punishes empathy.

This is why appeals to corporate “responsibility” ring hollow. Responsibility without authority is theater. Responsibility without legal permission is sabotage.

The Real Choice We Keep Avoiding

The uncomfortable truth is that we made this choice. Not once, but repeatedly.

We chose to enshrine shareholder primacy. We chose to treat corporations as profit engines rather than social actors. We chose to interpret fiduciary duty narrowly and enforce it aggressively.

Now, as climate collapse accelerates, we are watching the bill come due.

Insurance companies are not abandoning homeowners because they are uniquely evil. They are doing so because the law instructs them to.

Until that instruction changes—until we confront the century‑old decision that elevated profit above all else—these outcomes will multiply.

The fires will spread. The coverage will vanish. And we will keep pretending to be surprised.

That, too, is part of the system.